Industry Challenges and Overview

The Boston Consulting Group’s (BCG) extensive 15-year study, unveiled at the CII FMCG Summit, portrays a challenging landscape for the domestic FMCG sector. Between 2007 and 2023, the industry’s volume growth limped at a mere 3.4%, a stark contrast to the robust 6.1% rise in overall household consumption expenditure during the same period. This anemic growth is attributed to fierce competition from alternative spending avenues, coupled with a noteworthy doubling of prices in packaged household staples, home care products, and packaged foods since 2012.

Demographic Dynamics and Disruptions

The study shows that affluent households, making up 16% of Indian homes with incomes over Rs 10 lakhs per year, contribute a significant 32% to overall spending. However, disruptions like demonetization, GST implementation, and the Covid-19 pandemic have hit consumption harder in rural and semi-urban areas, making things tougher for the lower end of the FMCG market.

Future Outlook and Strategies

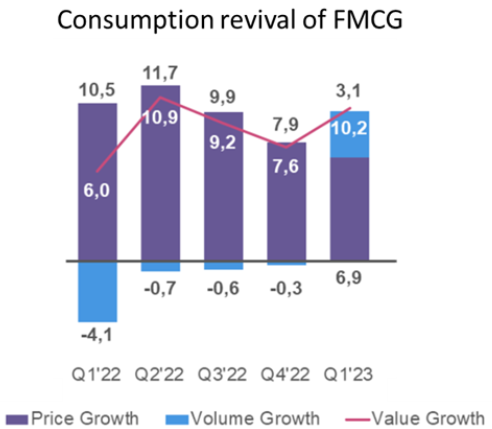

Despite prevailing challenges, in the opening quarter of 2023, the Indian FMCG industry experienced a notable turnaround marked by positive shifts in both rural markets and non-food segments. This shift comes after a challenging stretch of six quarters. With a drop in the overall inflation rate, consumers are cautiously optimistic, reflecting a newfound willingness to open their wallets. The study maintains optimism about future growth, projecting a potential 5-6% increase in industry volume over the next decade.

1. Price-Point Packs (PPP) as Growth Drivers

FMCG companies are leveraging Price-Point Packs (PPPs) across product segments, contributing significantly to overall business. Hindustan Unilever Ltd (HUL) reports one-third of their business in specific categories originating from PPPs, signaling a growing consumer preference.

2. Rural Focus and Consumer-Centric Approach

To tap into rural potential, industry leaders stress the importance of concentrated efforts in rural distribution. Sudhir Sitapati, CEO of Godrej Consumer Products, advocates for heightened focus on rural areas, where approximately 60% of India’s population resides.

To optimize growth, companies are urged to target consumers at both ends of the spectrum. Prabha Narasimhan, Managing Director of Colgate Palmolive India, advises playing the “price piano” effectively, catering to consumers with limited resources through PPPs and addressing those with higher spending capacity.

3. Volume Growth Strategies Across Markets

Anticipating volume growth, FMCG companies strategically position themselves in both urban and rural markets. Mohit Malhotra, CEO of Dabur India, foresees volume pick-up in these areas, driven by increased penetration, expanded reach, and strategic pricing.

4. Balanced Rural Growth Approach

Saugata Gupta, MD & CEO of Marico India, recommends a balanced approach for rural growth, emphasizing the necessity of a mix of volume-based growth and category development to cater to diverse consumer needs.

5. Insights from Industry Leaders

Insights from industry leaders at the CII FMCG Summit highlight the significance of a robust pack strategy. Deepak Subramanian, Executive Director – Home Care at HUL, prompts a critical evaluation of pack strategies to ensure they align with evolving consumer preferences.

Leave a Reply

You must be logged in to post a comment.