Introduction

Walt Disney and Reliance Industries entered a non-binding agreement for their Indian media operations merger on December 25, 2023. Under the merger agreement, Reliance Industries will hold 51 percent of stakes via a combination of shares and cash, while Disney will be entitled to the remaining 49 percent, which indicates more power to the Reliance executives. Under the agreement, the two companies will raise $1-$1.5 billion towards the merger, while Reliance will have more stake in the firm. The deal is set to be finalized by February 2024.

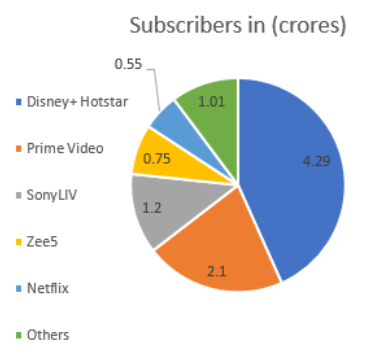

Streaming industry

India’s video streaming market reached nearly 100 million subscriptions in 2023, as companies ramped up their spending on original content in local languages and extensively marketed them. India’s top six metro cities accounted for 33 percent of the total paid subscriptions in the country.

The Deal

- Disney+ Hotstar is Disney’s biggest streaming service globally in terms of users but started shedding subscribers after losing the Indian Premier League Cricket (IPL) to streaming app JioCinema in a $3 billion deal last year.

- Disney paid $3 billion for the same five-year rights, but for broadcasting the content on TV. Besides this, Disney, earlier this year, announced that it would stop streaming HBO content with Reliance picking it up and making it available on JioCinema.

After losing approximately 20 million subscribers this year, Hotstar has tried to woo customers back by offering free streaming of the Cricket World Cup on mobile, recording a peak of 5.9 concurrent viewers for the final. However, it remains to be seen if this translates into increasing subscriber count.

- A merger would create one of India’s biggest entertainment empires, competing with television interests such as Zee Entertainment and Sony, and streaming giants including Netflix and Amazon Prime, according to a Reuters report. The proposed deal would create a unit under Reliance’s Viacom18 to take control of Star India through a stock swap.

- It is reported that the new board is expected to have at least two directors each from Reliance and Disney. Sources indicate Mukesh Ambani’s eldest son, Akash Ambani, will be on the board of directors, though Uday Shankar of Bodhi Tree, which holds the largest shares in Viacom18 after Reliance, is also a contender for the seat.

Similar Deals: 1. Sony and Zee 2. Viacom18 and Jio Cinema 3. Discovery and Warner Media

| Advantages for Viewers | Concerns from Viewers’ Perspective |

| 1. Diverse Content Library: A merger may result in a more extensive and diverse content library, offering viewers a broader range of choices and genres. | 1. Subscription Costs: Viewers may be concerned about potential increases in subscription costs or the introduction of new fees following a merger. |

| 2. Improved Content Quality: Synergies between platforms could lead to higher production values, better storytelling, and enhanced overall content quality. | 2. User Experience Changes: Changes in the user interface or navigation may lead to initial discomfort and dissatisfaction among existing users. |

| 3. Cross-Platform Accessibility: A merged platform may offer seamless cross-platform accessibility, allowing viewers to access content from different devices more efficiently. | 3. Content Curation Concerns: There might be concerns about changes in content curation, leading to the removal of favorite shows or a shift in the platform’s focus. |

| 4. Enhanced Features: Viewers may benefit from new features, such as personalized recommendations, advanced search options, or exclusive content bundles. | 4. Data Privacy: Mergers may involve the sharing of user data between platforms, raising concerns about data privacy and security. |

| 5. Streamlined Subscriptions: A merger could potentially offer bundled subscription options, simplifying billing and providing cost-effective packages for viewers. | 5. Loss of Originality: Viewers may worry that the unique identity and originality of each platform could be diluted, affecting the distinctiveness of content. |

| 6. Single Sign-On: A merged platform may introduce a single sign-on system, making it easier for viewers to access content without multiple logins. | 6. Technical Glitches: Integration processes may lead to technical glitches, affecting the streaming experience and causing frustration among users. |

| 7. Exclusive Content Access: Viewers might gain access to exclusive content that was previously available only on one of the merging platforms. | 7. Customer Support Issues: Increased user base and changes in operations may result in customer support challenges, leading to slower response times. |

Leave a Reply

You must be logged in to post a comment.